Adopted strictly for illustrative purposes by Intelscape Limited during web design. Copyright belongs to owner.

Six Mega-trends that Will Take Insurance Back to the Future

By Susanne Møllegaard

CEO and Co-Owner, Process Factory

The insurance industry started out as a safety net among peers. Over time the help has become organized, leading first to mutual insurance companies and later to stock insurance companies. As much as this development has led to a greater degree of professionalism, it has also led to a kind of alienation. Furthermore, there is a problem with the basic structure of the insurance products, since the interests of the insurer and the insureds are not aligned. Broadly speaking, the insurer will be better off if premium levels are maximized and claims costs are minimized, whereas the opposite will be true for the insureds.

Basically this has led to a situation of mutual mistrust between the involved parties. The lack of trust inspires the insureds to act with caution when notifying a claim or even to fraudulent behaviour, and the insurer to apply strict underwriting rules, complicated insurance terms, and costly claims processes. The consequences are high cost levels leading to high premium levels and low customer satisfaction. The great news is that all this is about to change.

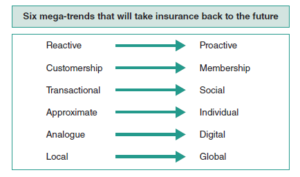

A number of mega-trends today are influencing the insurance industry in ways that many consider will bring back trust (see Figure 1). Paradoxically enough, the old-fashioned trust mechanisms are recreated by the application of modern technology and modern ways of coexisting in the sharing economy, bringing the industry “back to the future”.

Figure 1

Mega-trend 1: From Reactive to Proactive

The main focus of insurance is reimbursing the costs after the occurrence of an incident. Despite experimenting with claims prevention initiatives mostly motivated by a wish to reduce claims cost, no traditional insurer has yet come up with game changing initiatives. From a customer perspective, however, claims prevention is preferable to claims coverage, and with the perspectives of the Internet of Things (IoT), we see the rise of the proactive insurance policy that aligns the interests of the insurer and the insured.

We see startups taking this trend seriously, replacing traditional insurance with claims prevention services using smart wireless sensors to detect fires, water damages, and break-ins. An example is the British InsurTech startup Neos teaming up with international specialist insurer Hiscox to offer a new type of home insurance that combines protection and insurance in new and forward-thinking ways. California-based Omada Health is another great example. They provide clients with a box of gadgets to monitor health, weight, activity level, etc., thereby focusing on reducing the risk of various chronic diseases before focusing on reimbursements. And we see car insurers such as Swedish insurer Moderna and global insurer Discovery using telematics to help drivers improve their driving style and avoid risks.

You could say that these intelligent products are a two-edged sword. They open up new types of risks while at the same time providing us with new ways to monitor and prevent risks.